Mate Rimac has built a multibillion-dollar EV technology company, released a record-breaking electric hypercar and taken the reins of storied French marque Bugatti. Next up: Turning 34

Mate Rimac (his name is pronounced MAH-tay REE-mats) sat at a table, facing a camera. To his right was Oliver Blume, the CEO of Porsche, and to his left its finance chief, Lutz Meschke. They were about to host a video conference to announce the deal to merge Bugatti, for which Porsche has responsibility within the vast Volkswagen Group, with Rimac’s eponymous startup hypercar maker. A small number of journalists from the business media joined Robb Report on the call, among them the Financial Times and Bloomberg. Blume and Meschke were dressed in sober business attire, as you’d expect of German C-suite executives making a major announcement to the world’s press, and they sat stiff and upright. But as the 33-year-old Rimac relaxed into his chair, his sneakers emerged from beneath the table, followed by a pair of bare legs. The wunderkind of the hypercar world was about to be handed control of one of its most fabled marques, and he’d chosen to wear shorts for the occasion

Rimac doubtless meant no disrespect, but his casual dress served as useful visual shorthand for a transfer of power extraordinary even by the turbulent standards of the supercar industry. Stewardship of arguably the world’s most prestigious marque, founded 112 years ago by one of the great automotive auteurs and maker of some of the most beautiful, powerful cars ever to grace the road, was passing from Europe’s largest manufacturing company to a startup that began in a tiny nation 12 years ago by someone then barely out of his teens. Later that evening there would be a glossy event livestreamed from the spectacular 14th-century Lovrijenac fortress perched high over beautiful, ancient Dubrovnik and the opal waters of Croatia’s Adriatic coast. Rimac leapt on stage to acknowledge the significance of what was happening and the responsibility he was assuming. He was now wearing a well-cut suit but still kept the sneakers.

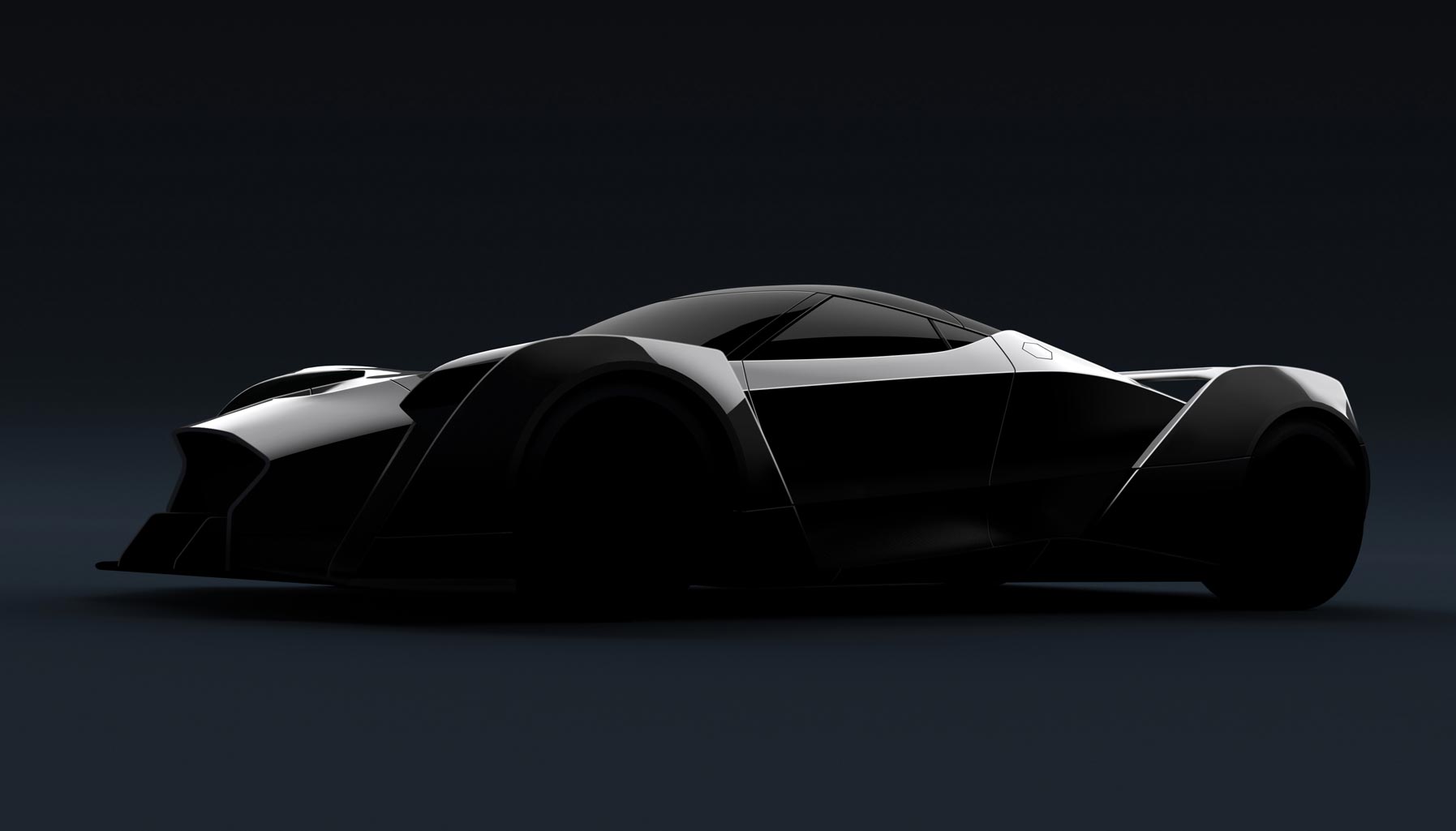

Despite his youth, Rimac is already acknowledged by his peers as one of the preeminent modern supercar makers, a successor to Ettore Bugatti alongside Horacio Pagani, Christian von Koenigsegg and Gordon Murray. The club of engineers who have created the cars and companies that carry their names from scratch is exclusive, and Rimac had only officially joined it when the Bugatti deal was announced in early July. The Rimac Nevera, his first proper production electric hypercar, was tested by Robb Report and a handful of other media in June, and customer deliveries are just starting.

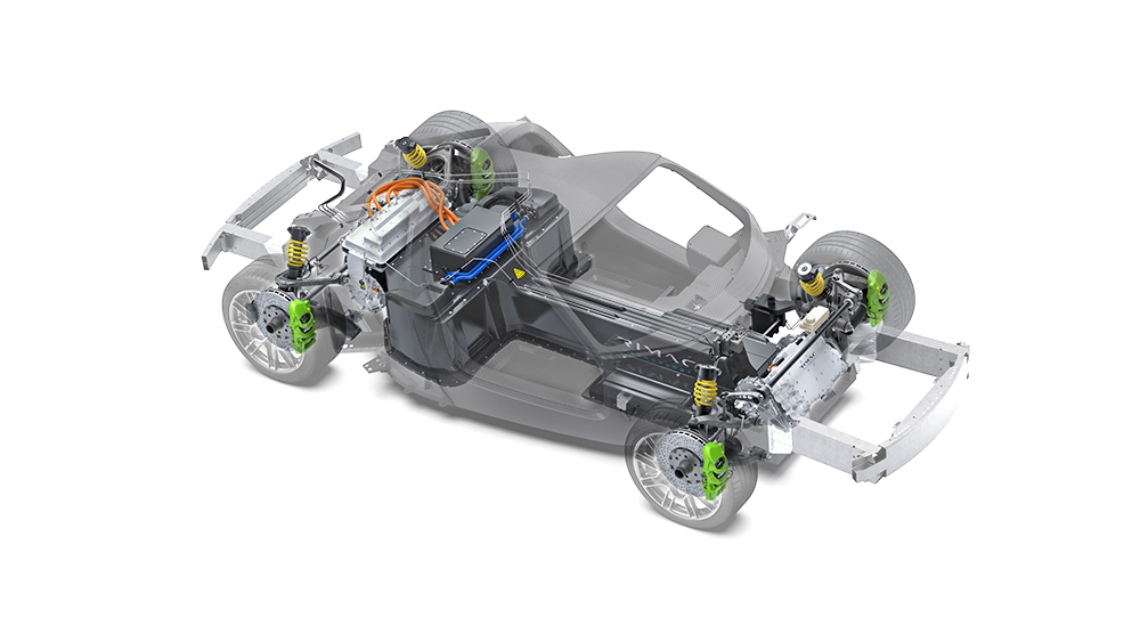

But Rimac is already an established player. While developing his own hypercar, he has built a multibillion-dollar business supplying his high-performance electric-propulsion technology to at least 15 major carmakers, including Ferrari, Aston Martin, Mercedes and Rimac’s fellow auteur Christian von Koenigsegg. Porsche and Hyundai are not only customers but also investors with significant equity stakes, and Pininfarina likes the Nevera so much that it’s using the car as the basis of its new 1,877 hp Battista. His business has grown so fast that Rimac simply hasn’t had time to get his own hypercar on sale until now.

The optics of the Bugatti-Rimac merger may seem odd at first, but the logic is indisputable. A new generation of electric Bugattis needs a transcendent level of performance, but Volkswagen has lost the will to fund it. Big car companies can spend like the US military. Analysts estimate that VW has invested at least US$2.4 billion (S$3.24 billion) in Bugatti since it took control in 1998 and lost around US$5 million (S$6.74 million) on every Veyron sold. It spent about US$420 million (S$566.16 million) creating the Chiron from the bones of the Veyron, and sources close to the deal say VW expected to spend the same again electrifying this 16-year-old platform.

Rimac is said to have offered to develop an all-new Chiron successor for around US$240 million (S$323.52 million). Rather than write a check for that sum, VW proposed a merger. No cash is believed to have changed hands. The new Bugatti-Rimac will be 55 per cent owned by the Rimac Group and 45 per cent by Porsche, on behalf of Volkswagen. For now, the two brands will continue to be designed and built separately: Bugattis in Molsheim, France, and Rimacs from 2023 at its new campus headquarters near Zagreb.

Rimac is putting only his hypercar-making business into the new joint venture. His fast-growing operation supplying high-performance EV power trains and other equipment to the global carmakers is a separate business: Rimac Technology, solely owned by Rimac Group. Only 150 Neveras will be made, and Bugatti currently builds fewer than 100 cars each year. Even when the combined Bugatti-Rimac is at full production, the venture will account for only 15 to 20 per cent of Rimac Group turnover. Rimac Technology will make up the rest, and it’s about to grow rapidly. It has contracts in place to supply major premium carmakers with components and complete power trains for the high-performance variants of their pure-electric models. With volumes of up to 100,000 each year, it’s a huge leap in scale for Rimac. Your next car might not be a Nevera, but there’s a chance it will have Rimac tech on board.

Rimac remains the largest shareholder in the Rimac Group, with a 37 per cent stake. The latest funding round is believed to value the group in the mid-single-digit billions, giving him a nominal net worth of around US$2 billion (S$2.7 billion). In addition to Porsche AG’s 45 per cent stake in Bugatti-Rimac, Porsche’s venture-capital arm owns 24 per cent of Rimac Group, giving Porsche indirect majority ownership of Bugatti-Rimac. But Porsche is clear that there is no combination of voting rights, no de facto or de jure control, and that having Rimac as CEO of all three companies is one of the reasons it wanted the deal. “As a shareholder we want a real entrepreneur as CEO,” Blume says. “It is our clear strategy to pass operational control to Mate.”

Perhaps most strikingly, the deal means that despite that storied history, a 10-figure investment by VW over 23 years of ownership and hundreds of Veyrons and Chirons delivered, Bugatti is valued at less than Rimac’s Nevera-making operation alone, which is only just beginning to deliver customer cars. The reason is simple: Bugatti is almost worthless without the ultrahigh-performance electric power train it will need in the EV age.

Volkswagen doesn’t want to make the investment required to develop one. Rimac has one already. Without it, VW was seriously considering putting the Bugatti brand into cold storage.

Even by the hyper-compressed standards of the young entrepreneurs remaking the modern world, this has been a wild few months for Mate Rimac. First the launch of the Nevera in June, then the Bugatti announcement in early July and, later that same month, marriage to his childhood sweetheart. Then a tour of the US, starting in Los Angeles and Pebble Beach in August, to meet not only customers for his US$2.4 million (S$3.24 million) Nevera but also Bugatti’s established clientele, who might be a little wary of both the brand’s transition to electric propulsion and its youthful new boss. Next he headed back to Zagreb to complete the transfer of power from Bugatti’s current CEO, the urbane Stephan Winkelmann, who also heads Lamborghini. Then he’ll continue the process of creating a successor for the Chiron.

“This year, just as you say, it’s like everything is coming together. It’s just f**king insane for me,” he tells me from New York. I’ve spoken with him several times over the past, mad few months: first spending a relaxed couple of days with him on the bleak but beautiful Croatian island of Pag, where he launched the Nevera, and later on that conference call. He looks tired now, after his fierce travel schedule. But he is typically generous with his time, disarmingly honest, asking questions as well as answering them, and generally personable, approachable, funny and human: atypical, perhaps, for a tech entrepreneur.

Every cent of that US$2 billion (S$2.7 billion) net worth is self-made. Rimac was born in Bosnia to an ethnically Croatian family of migrant construction workers, a tradition of exodus accelerated by the vicious conflict that raged as Yugoslavia disintegrated. Rimac moved to Germany at age two and then to an independent Croatia in his early teens, where he was teased for his hick Bosnian accent. But his talent for electronic engineering was spotted and encouraged by a teacher, and by age 18 he had registered a couple of patents and won a national prize for an early example of wearable tech: a “glove” that recognized hand gestures and could be used instead of a mouse. It’s still on display in a cabinet at Rimac’s HQ.

Rimac liked cars as much as gadgets and bought a battered BMW 3 Series, as it was the cheapest way to get a rear-wheel- drive car that he could race and drift. His best friend, Goran, inadvertently gave a multibillion-dollar business its start when he blew the BMW’s engine, prompting its 20-year-old owner to combine his two passions and replace the gas engine with an electric motor. It worked okay but not well enough for Rimac, who pulled it out again and tinkered with it, beginning a constant process of obsessive iterative improvement over 13 years, which he admits drives him and his staff crazy but has now resulted in his owning the best high-performance EV propulsion tech in the world. And most of Bugatti.

I ask him to define what makes Rimac stand apart – what has brought so many established carmakers to Croatia in search of a way to make a fast EV quickly?

“Look at the Nevera,” he says. “Almost everything in it was developed internally. This is what makes us different. There is no other car company that has developed so many things in a car by themselves. And the second thing is execution. There are many other startups working on their cars. Many of them have existed longer than us, and all of them have more funding than us. But we are the first after Tesla who finished the car and started production. Execution is everything.

“And we do it for a fraction of the cost of others. It’s not because Croatian salaries are lower. It’s because we do things very differently from the other carmakers. And lastly, of course, it’s performance. There’s nobody even close to us.”

This is demonstrably true. In August a Nevera was independently tested at the Famoso dragstrip in California. The Bugatti Chiron Sport held the previous world production-car acceleration record, covering the quarter-mile in 9.4 seconds. The 1,914 hp Nevera ate up Famoso’s sticky tarmac in just 8.582 seconds at a terminal velocity of 167 mph. That 0.8 second difference is a lifetime in these matters: Now combustion engines will never catch up. The Tesla Model S Plaid faced off against the Nevera in three races a few days later and, though it also beat the Chiron’s time, as promised, with a top time of 9.272 seconds, it was a long way behind the Nevera.

The Nevera’s stellar price automatically puts it in the beyond-premium segment of the car market, and while it’s surprisingly comfortable and practical for something with such terrifying performance, it was never intended to be a luxury good. Bugatti is different, though, and this young, egalitarian, unpretentious electronic engineer is now in control of one of the world’s great luxury brands. The glamour of running a marque like Bugatti and delivering a luxury customer experience doesn’t seem to drive him; the question of whether he has plans to reinvent super-premium motoring as comprehensively as he has reinvented electric performance cars remains.

“For me, it’s more about cars and ecology,” he says. “For the Nevera, luxury was not really a concern: It’s more about tech and performance. Luxury is much more important to Bugatti. That’s why I think the two brands can coexist. Over the last 20 years, no other car had Bugatti’s performance. That’s what made them special. Then came craftsmanship, quality and details, but number one was performance. But now performance is increasingly commoditized. You have a five-seat sedan like the Model S being faster-accelerating than pretty much anything else on the road. So what puts you at the top of the pyramid in the future? Is it really just performance?

“Of course we’ll still do hypercars for Bugatti. We are working on a Chiron successor. But looking at Bugattis of the past, there haven’t been only sports cars. When performance alone is no longer the top selling point, what puts you at the pinnacle? Is it still a two-seat, rear-engine hypercar? Or might there be something else? There’s an opportunity for Bugatti in the future to have very interesting cars that are completely different to other models on the market, while Rimac remains a maker of very high-performance sports cars. But we haven’t figured that out ourselves yet.”

The details haven’t been officially confirmed, but there will be two all-new Bugattis engineered by Rimac before 2030. The first will be a 2,000 hp, two-seat hybrid hypercar, due around 2025. The Chiron’s 8.0-liter W-16 engine shorn of its four turbos will make half of that power and a Rimac electric-drive system the rest. Next comes a pure EV by 2030. From his hints, we may reasonably expect a four-door grand coupe to differentiate it from future Rimacs and to continue where Bugatti’s fabulous but ill-fated Royale of the 1930s left off.

Rimac will be involved in every aspect of their design. While his fellow Croat Adriano Mudri heads the company’s design department and Rimac’s specific expertise is in electric power trains, he obsesses over every aspect of his car’s design in the broadest sense.

“With a car, everything is important,” he says. “I define every little detail. The company is still very dependent on me for that, but I don’t think that’s good. I think that’s a personal failure.”

It’s clearly the cars, their design and engineering, and the environment that enthuse him. And given the tiny volumes in which his own cars will be made, his attention may begin to turn to some unexpected new projects where the ecological benefit is greater.

“I love hypercars. I love doing this stuff,” he says. “But in reality, it has a low impact on society. Electrification is an important step, but on its own it’s not going to save the world. I believe there are much bigger levers. In automotive terms, the big impact comes from new mobility, and we want to be a significant part of it. It doesn’t mean that we will stop doing what we are doing now, but for the last few years we’ve been working on a robot taxi service and the whole ecosystem around it. I don’t want to say too much about it. I’d rather do it and then show it. But you’ll see it early next year.”

His fellow supercar auteurs may be glad to see Rimac’s intellect and energy distracted by more pedestrian projects, though at this level there’s little conventional rivalry: Many of their customers can simply buy every model that interests them, and the marques are as likely to collaborate as compete. “It has been amazing to follow and support Mate’s rise,” says Christian von Koenigsegg, whose Regera uses Rimac’s batteries. “He has stayed true to his calling since a young age. For sure it was a big bet for us to trust such a young company and founder as a supplier. Neither Mate nor myself are traditional engineers, as we don’t have academic engineering backgrounds, but are more self-taught. I even think this might be a prerequisite for what we do as we are less limited in our thinking, and by working together we showed the big boys there is a new era coming.

“Bugatti always prided itself on being a part of a large group,” he continues. “We at Koenigsegg have always taken pride in standing on our own two feet. Now Bugatti has been taken over by a similar company with a similar philosophy to us, so now the extreme-sports car producers are more stand-alone than before. That’s a big shift. It’s interesting how the world changes.”

The world might be moving Rimac’s way, but there’s still risk. Those big contracts and the Bugatti deal make funding easy now, but he has to scale up fast, delivering power trains in far higher volumes than before and to perfect, German premium-marque quality levels from job one. By his own admission, he also has to make the business less dependent on him and maintain the energy and agility of a startup while acquiring the scope of a proper, grown-up business. As even Elon Musk can attest, that’s not easy.

From New York, Rimac tells me that he has been looking at the stock tickers in Times Square and thinking again about an IPO. He doesn’t want to do it until he is shipping Neveras, fulfilling those new bigger contracts, has built his US$240 million (S$323.52 million) campus headquarters near Zagreb for the 2,500 employees he will have by 2023 and has revenues in the US$600 million (S$808.8 million) range, which will happen rather earlier.

He wonders if he made a mistake in not going public sooner. “This is my first job, you know?” he says. “I don’t know how many things I’m doing good, or how many things I’m doing very badly. I guess there must be both.” Given Rimac’s current valuation of around US$6 billion (S$8.09 billion), and potentially much more if the robotaxi bet comes in, his investors and the major carmakers seem to think he’s doing okay. Maybe he’ll wear shorts when he finally rings the Nasdaq opening bell.

This story was first published on Robb Report USA