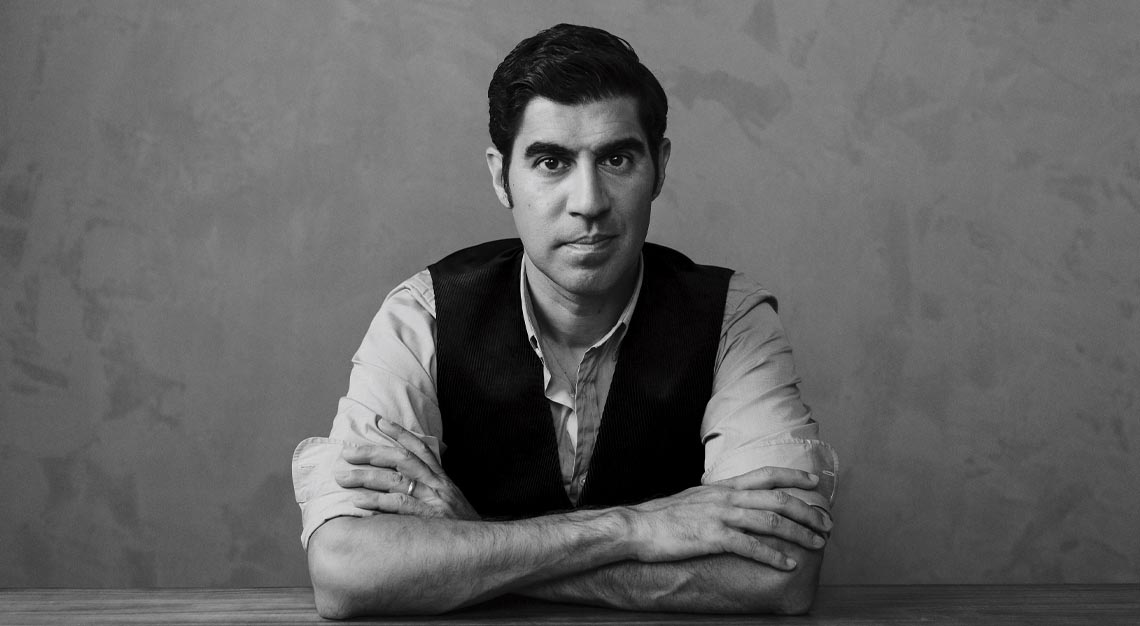

“No risk, no reward,” says Walter de Oude, founder of a fintech startup and member of the Robb Report Singapore Thought Leaders community

Walter de Oude spent over two decades in Asia building a career in insurance and financial services and was the CEO of HSBC Insurance Singapore before leaving the company to found Singlife in 2014. Leveraging on digitalisation, Singlife modernised the insurance business, making it more accessible and transparent. The company went on to merge with Aviva Singapore in 2020 in what was the country’s largest insurance deal, creating a home-grown insurer with over one million customers. Today, de Oude continues to serve as non-executive founder director of Singlife with Aviva. He has also established another fintech startup, Chocolate Finance, which recently attracted US$19 million in Series A funding.

How do you feel about risks? What are some of the biggest risks that you have taken?

No risk, no reward. Quitting jobs to establish a startup is a big risk strategy.

What do you consider to be your top professional achievement?

The Singlife acquisition of Aviva in 2020.

What’s your greatest fear?

That my kids lack ambition.

If you could change one thing about the world, what would it be and why?

Population growth in poor economies. The world is tough enough for those who are here already. Why bring new people into a terrible existence?

How would you like to be remembered once you leave Earth?

I don’t really care. I’m 100 years in a span of billions. If I’m remembered for living life to its fullest, I would be happy.

If you could have a superpower, what would it be and why?

Mind manipulation. If everyone supported my point of view, I could achieve much more, much faster.

Editor’s note: Get to know the full Thought Leaders community here.

Photography by Sayher Heffernan

Styling by Wei Lun Tok

Hair & Makeup by Angel Gwee

Credits: Chanel Beauty and L’Oréal Hair Professional;